50/50 insurance claim: both drivers are assigned 50% fault, so each payout is reduced by 50%; deductibles and rental reimbursement are usually prorated, and premiums may rise.

In a state as large as California, which contains some of the biggest cities in the country, it’s natural that it isn’t immune to dangers on the road.

Even though preliminary reports show a 43% drop in motor-vehicle deaths through June 2025 compared to the year before (nearly 1,000 fewer lives lost), collisions still happen daily, leaving drivers to deal with medical bills, property damage, and insurance battles.

One of the most frustrating situations drivers face is when an insurance company rules a crash as 50/50 liability. For many drivers, this raises an urgent question: how to fight a 50/50 insurance claim and avoid being unfairly penalized.

In this article, we’ll take a look at what 50/50 liability means in California, why insurers use it, and what you can do if you believe the decision doesn’t reflect the facts of your accident.

When an accident is ruled 50/50, it means both drivers are considered equally at fault. Instead of one party bearing full responsibility, the blame is split down the middle, and so are the damages.

This idea comes from a legal principle called comparative negligence. Under comparative negligence, the amount of compensation you can receive depends on how much of the accident was your fault. For example, if you were 40% responsible and the other driver was 60% responsible, you could only recover 60% of your damages.

There are three main systems used across the U.S.:

This lets you recover damages even if you were mostly at fault. You can collect whatever portion matches the other driver’s share of responsibility.

Under this, states place limits on how much fault you can have before losing the right to collect damages. There are two main versions:

If you are found to be 50% or more at fault, you cannot recover any damages. For example, if you and the other driver are equally responsible for a crash, you would walk away with nothing under this rule.

If you are found to be 51% or more at fault, you cannot recover damages. In this version, you can still collect if the fault is split 50/50, but once you are considered more responsible than the other driver, you lose the ability to claim compensation.

The harshest rule, where even being 1% at fault prevents you from recovering damages.

California follows the pure comparative negligence rule, which is written into Civil Code § 1714. This means that even if you were 90% at fault in a crash, you could still seek 10% of your damages. In a strict 50/50 case, however, each driver’s recovery is cut in half, since both sides are deemed equally negligent.

This system is designed to be fairer than the “all-or-nothing” approaches used in other states, but it also explains why insurance companies in California may be quick to label accidents as 50/50. Splitting liability limits their payout and can leave drivers struggling with reduced compensation and higher premiums.

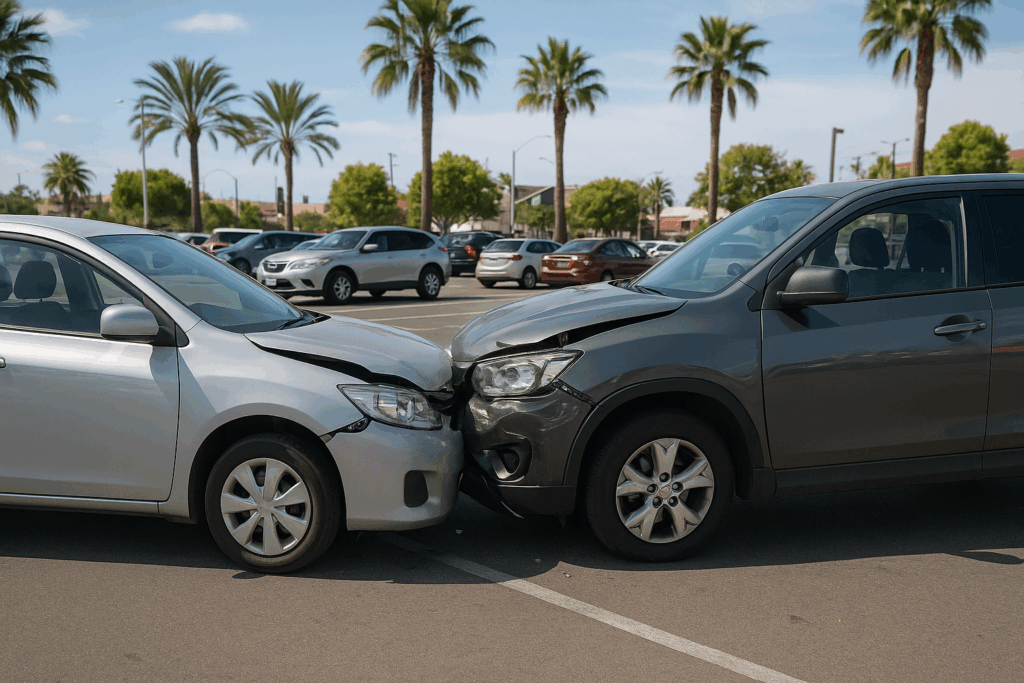

Certain crash scenarios tend to result in insurers calling liability “unclear” and defaulting to a 50/50 ruling. These include:

In each of these cases, limited evidence or conflicting stories can push insurers toward the simplest outcome: splitting the blame evenly.

When your claim is ruled 50/50, the financial consequences are immediate:

While California’s pure comparative negligence rule still gives you the right to recover part of your damages, a 50/50 split can feel like a half-win at best, leaving you with reduced compensation and ongoing financial strain.

What to Do if You Disagree with an Insurance Settlement

Disagreeing with a settlement in California doesn’t mean you’re out of options. Here’s a path you can follow:

Each step raises the pressure on the insurer, showing that you’re serious about pursuing fair compensation.

When you’re handed a 50/50 ruling, it often feels like the insurer took the easiest way out.

But the answer lies in building a stronger case than the one your insurer relied on. To fight back, you’ll need proof. You’ll have to re-tell the story of your accident with stronger evidence than before. A dashcam clip showing the other driver drifting into your lane, or a witness statement confirming you had the right of way, can shift the balance.

In some cases, hiring an accident reconstruction expert is worth it. Their analysis of vehicle damage and road conditions can uncover details that adjusters overlook.

Once you’ve gathered your evidence, put everything into a clear, written appeal and submit it formally. If the insurer refuses, escalate the issue internally until a higher-level review is triggered. The goal is to make the 50/50 finding harder to justify.

How to Negotiate an Insurance Payout After a 50/50 insurance claim

Negotiation is where persistence pays off.

Say your repair bill is $12,000, but the insurer’s payout only covers half. Instead of accepting the figure, you can reframe the conversation by presenting organized proof of damages: a single packet with repair shop quotes, medical receipts, and wage loss letters from your employer. This makes it harder for the insurer to dismiss your claim as inflated or incomplete. If their next offer still undervalues your losses, counter firmly and explain why your number better reflects the costs.

Insurers often test how determined you are, but with a strong paper trail and, ideally, a lawyer doing the talking, you can move closer to a settlement that doesn’t leave you carrying the burden.

Being placed in a 50/50 ruling can leave you with reduced compensation, higher out-of-pocket costs, and rising premiums. If you’re unsure how to fight a 50/50 insurance claim in California, Thompson Law can step in to protect your rights and pursue the full recovery you deserve.

Contact us today for a FREE CONSULTATION and let our team guide you through your options.

We proudly serve clients across California, including Los Angeles, San Diego, San Jose, San Francisco, Fresno, Sacramento, Long Beach, Oakland, Bakersfield, Anaheim, and many other communities. Whether you need a dedicated Los Angeles personal injury lawyer or legal representation anywhere else in the state, our team is ready to help.

A 50/50 insurance claim means both drivers are assigned equal fault. Each party’s payout (property damage and, in many states, injury damages) is reduced by 50%.

Commonly in “word-against-word” crashes—parking-lot collisions, lane changes, merges, and intersections—when evidence is limited or liability is disputed.

Your recovery is cut in half, and you may still pay your deductible (you can sometimes recover 50% of it from the other insurer). Rental coverage and total-loss math also reflect the 50% reduction.

It can. Many carriers treat 50/50 as an at-fault accident on your record. The impact depends on your insurer, state rules, prior history, and accident-forgiveness, if any.

Yes. Strengthen liability with crash-scene photos/video, dashcam, repair angles, event-data recorder (EDR) pulls, 911 calls, witness statements, and police report corrections. An attorney can demand a re-eval or pursue subrogation/litigation.

Yes. Comparative-negligence rules vary. In some states you can still recover with partial fault; in “modified” systems you may be barred at 50%–51%. Always check your state’s negligence standard.

Sí. Hablamos español. We provide bilingual support so Spanish-speaking clients have full access to our attorneys.

Contact us today for a FREE CONSULTATION!

Thompson Law charges NO FEE unless we obtain a settlement for your case. We’ve put over $1.9 billion in cash settlements in our clients’ pockets. Contact us today for a free, no-obligation consultation to discuss your accident, get your questions answered, and understand your legal options.

State law limits the time you have to file a claim after an injury accident, so call today.