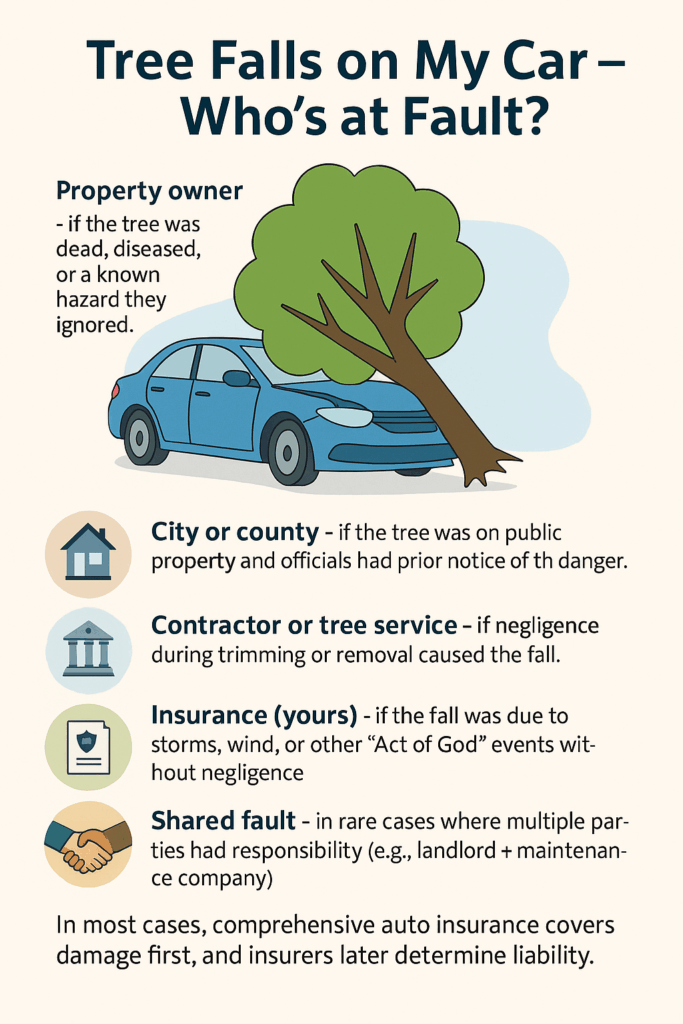

In most cases, comprehensive auto insurance covers damage first, and insurers later determine liability.

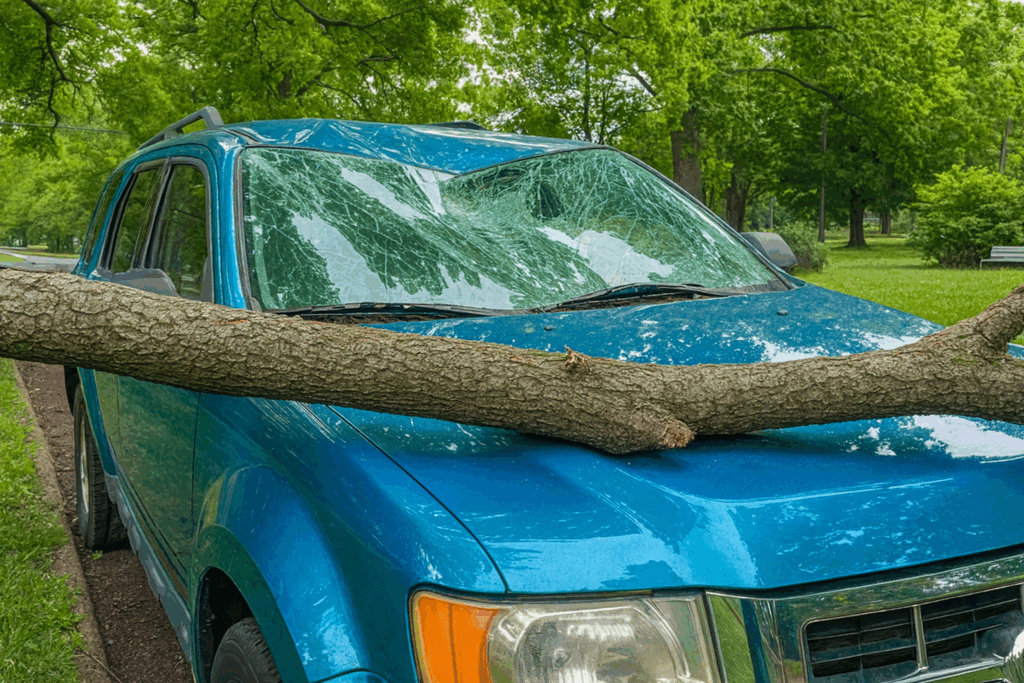

Having a tree fall on your car is something you’d think has only a small chance of ever happening. Yet when it does, the damage can be both costly and confusing to deal with. Beyond the immediate frustration of seeing your car crushed, there’s the question of who should pay for the repairs.

Many drivers are left wondering, tree falls on my car who’s at fault? The answer usually depends on whether negligence, property ownership, or insurance coverage applies.

Is it the property owner where the tree stood, or will your own insurance have to cover it?

In California, for example, CBS Sacramento reported on a Modesto woman whose car was totaled when a city tree came crashing down, leaving her with nearly $10,000 in repair costs. When she filed a claim, the city rejected it, saying there had been no recent complaints or service requests about the tree. Cases like this show how quickly a fallen tree can raise tough questions of responsibility and insurance coverage.

In this article, we’ll take a look at what determines fault, how insurance comes into play, and the practical steps to take after such an incident.

When asking tree falls on my car who’s at fault, the core issue usually comes down to negligence and whether a property owner ignored a known hazard.

In most cases, the property owner where the tree stood may be liable if they ignored a clear hazard. That means if the tree was visibly dead, diseased, or leaning dangerously, and they failed to take action, they could be considered at fault for the damage.

To hold a property owner accountable, you would typically need to show that:

As licensed adjuster James Kaylo explains, this kind of accountability requires documented proof, such as certified letters, repeated warnings, or expert assessments. Without evidence, insurers rarely succeed in recovering costs from the neighbor’s policy.

On the other hand, if the tree fell due to strong winds, lightning, or heavy snow, the incident may be classified as an “Act of God.” Insurance president Tom Larsen notes that in such cases, no negligence applies because the event could not have been foreseen or prevented, leaving the car owner to rely on their own insurance.

There are also limited scenarios where liability is clearer. As Ken Bradmon points out, an owner may be responsible if they were actively cutting down the tree when it fell, or if they ignored warnings about a visibly hazardous tree.

Because proving negligence can be complex, most claims are first handled through your own comprehensive auto insurance policy, which covers falling objects like trees regardless of fault. If negligence is later established, your insurer may attempt to recover costs from the property owner’s homeowner’s insurance, but the fastest way to get repairs is usually filing under your own policy.

Even when responsibility seems clear, resolving payment for a fallen tree often comes down to insurance policies. The type of coverage in place, both for the vehicle owner and the property owner, can determine how quickly repairs get underway.

From an insurance perspective, tree falls on my car who’s at fault is often secondary, since comprehensive auto insurance typically covers damage regardless of who owned the tree. If you carry comprehensive insurance, this is usually the most direct route to getting your car fixed. Comprehensive covers damage caused by falling objects, including trees, no matter where the tree came from. You’ll pay your deductible, and your insurer covers the balance of repairs.

If negligence is established against a property owner, their homeowner’s policy may ultimately pay for the damages. However, this usually only happens after your insurer pursues reimbursement, a process called subrogation. It’s rarely the first step, since homeowner’s claims can be delayed by investigations into the tree’s condition.

As long as you know which policy applies and how insurers typically handle these claims, you can avoid unnecessary delays and push their case forward more effectively.

So, when it comes to tree falls on my car who’s at fault, the answer depends on negligence — whether the property owner ignored visible risks or the fall was simply caused by an unavoidable natural event.

If the tree was clearly hazardous and the property owner ignored the risk, they may be liable. But if the fall was caused by sudden storms or other unavoidable forces, responsibility usually shifts back to your own insurance.

In most cases, the quickest way to handle the damage is through comprehensive auto coverage, while questions of negligence are sorted out later between insurers.

A tree falling on your car can leave you with more questions than answers, especially when it comes to repairs, liability, and insurance. The key is acting quickly: document the damage, notify your insurer, and understand your options if negligence may have been involved.

If you’re facing pushback from an insurance company or are unsure whether a property owner may be responsible, speaking with an attorney can help protect your rights and ensure you’re not left paying for damages that should be covered.

Contact our personal injury or property damage lawyer today for a FREE CONSULTATION and get clarity on your next steps.

Serving clients in:

Tree falls on my car who’s at fault? This is one of the most common questions drivers ask after storm damage or accidents with hazardous trees. The answer depends on negligence, property ownership, and whether comprehensive auto insurance applies.

Yes. Comprehensive auto coverage generally pays for repairs when a tree falls on your car, no matter who owned the tree. You may still pursue reimbursement later if negligence by a property owner can be proven.

You may have a claim if you can show the neighbor knew or should have known the tree was dangerous but failed to act. Documentation such as complaints, arborist reports, or city records strengthens your case.

Government entities can sometimes be held responsible, but strict notice requirements and short filing deadlines apply. Contact an attorney quickly to preserve your right to compensation.

Yes — especially if insurers deny your claim or liability is disputed. A lawyer can help gather evidence, negotiate with insurance companies, and pursue compensation for repairs, lost use, or related damages.

Thompson Law charges NO FEE unless we obtain a settlement for your case. We’ve put over $1.9 billion in cash settlements in our clients’ pockets. Contact us today for a free, no-obligation consultation to discuss your accident, get your questions answered, and understand your legal options.

State law limits the time you have to file a claim after an injury accident, so call today.