Some parts of Georgia’s roads are riddled with potholes, and for drivers, each one carries the risk of a pricey repair bill.

A 2023 AAA Auto Club Group survey reported that the number of drivers needing pothole-related repairs jumped 57% in just one year, with many facing an average repair bill of $406. That adds up quickly, especially since drivers often need multiple pothole-related repairs each year.

For Georgia motorists, the frustration is twofold: not only can a single jolt from a pothole knock your wheels out of alignment or damage suspension, but when a pothole damages my vehicle in Georgia, seeking compensation isn’t straightforward.

In this article, we’ll explain how liability works, the steps drivers should take after a pothole accident, and the process of filing a claim if you believe the city should be held responsible.

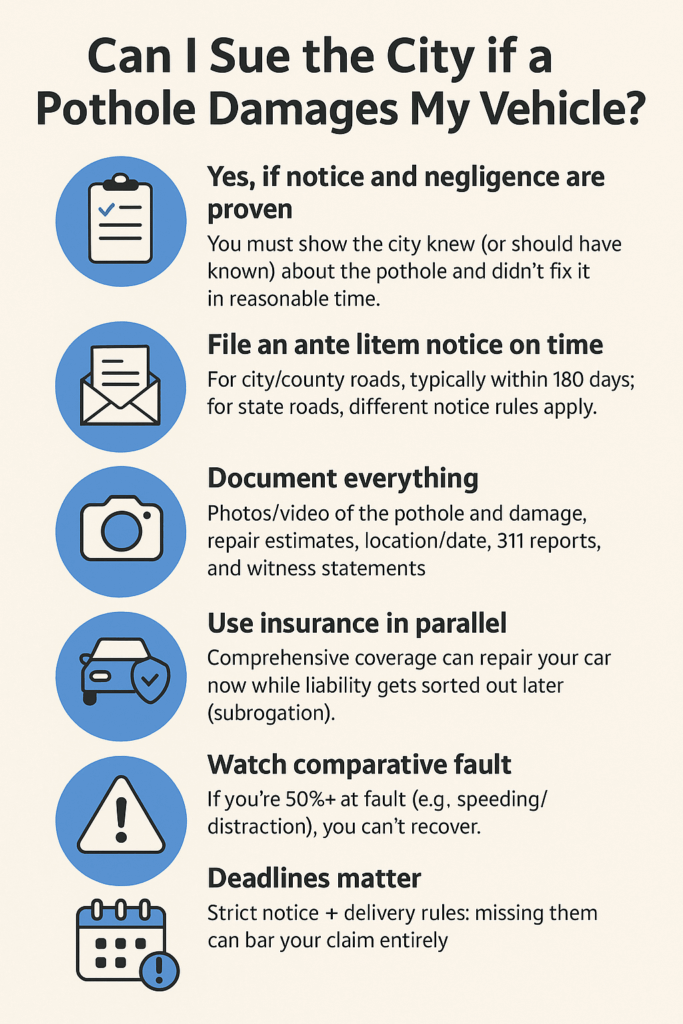

In Georgia, government agencies are generally protected from lawsuits through a legal principle called sovereign immunity — which directly affects claims when a pothole damages my vehicle in Georgia. Because of this, you can’t automatically sue the city or county for damages. To succeed, you must show that the government had prior notice of the pothole, failed to act within a reasonable time, and follow the strict procedures outlined in the Georgia Tort Claims Act (GTCA).

The GTCA, created in 1992, is the law that sets out when the state waives its immunity and allows people to bring claims. Under the GTCA, you may have a case if:

The GTCA sets the rules for how claims must be handled when the government can be held responsible. For drivers, this means following very specific procedures before a lawsuit is even possible.

The Act requires an ante litem notice, which is a formal written notification of your intent to bring a claim. This notice must be filed within a strict deadline, often 180 days, and sent to the proper government office. Missing this step can end your claim before it begins, no matter how strong your case may be.

Another important feature of the GTCA is its damage cap. Even if you succeed, the amount you can recover is limited by law, which may leave some repair costs uncovered. The Act also makes clear distinctions between claims against private parties and those against government entities. While a private property owner can usually be sued directly for negligence, claims against a city or state agency are only allowed within the GTCA’s narrow framework.

For a claim to succeed, you need to show that the city failed in its basic responsibility to keep roads safe. You need to prove that the city knew, or should have known, about the hazard and didn’t act quickly enough to repair it.

There are two main ways knowledge is established:

If you can show that the city ignored either type of notice and failed to fix the pothole in a reasonable timeframe, liability may apply in cases where a pothole damages my vehicle in Georgia. At the same time, Georgia law follows comparative negligence rules. This means that if you were distracted, speeding, or otherwise could have avoided the pothole, your compensation may be reduced.

Under Georgia’s 50% rule, you cannot recover damages at all if you are found more than half at fault for the accident.

If you believe the city should pay for pothole damage, the process starts before any lawsuit. Georgia requires a formal notice step called an ante litem notice, and the rules are strict. Here’s a rundown of what you can do (GA Code § 50-21-26 (2020)):

IMPORTANT: Georgia courts require strict compliance with delivery, content, and timing rules. A late notice, missing receipt, or wrong addressee can end your claim.

Notify your auto insurer promptly. Your property-damage coverage can move repairs forward while fault is evaluated. If the government later pays, insurers often seek reimbursement.

Georgia’s statute of limitations for property damage is two years, but notice deadlines are much shorter. Acting quickly protects your rights.

For many drivers, going through insurance is the most practical first step after a pothole damages my vehicle in Georgia, since comprehensive coverage usually pays for repairs regardless of city liability. Comprehensive auto coverage generally pays for damage caused by road hazards, including potholes, no matter who is at fault.

While you’ll still be responsible for your deductible, this route tends to move faster than waiting on a city’s response. If negligence is later proven against the city, your insurance company may attempt to recover what it paid out through subrogation. In some cases, if the pothole is on private property, a property owner’s liability or homeowners insurance could apply instead.

Yes, you may be able to sue, but only under strict conditions. If a pothole damages my vehicle in Georgia, the outcome depends on notice, negligence, and compliance with ante litem deadlines.

You must show the government had prior notice of the pothole and failed to repair it in a reasonable time. You also need to comply with ante litem notice requirements and filing deadlines. Without these steps, sovereign immunity will block the case.

Because of these hurdles, most drivers find using their own comprehensive insurance policy is the most reliable way to handle repairs quickly, while any negligence claims are left for insurers and attorneys to sort out later.

Pothole damage can leave you with expensive repairs and strict deadlines. An experienced attorney can review your case, ensure your notice is filed properly, and guide you through the process of holding the government accountable.

Contact our Georgia car accident lawyers today for a FREE CONSULTATION and find out what options may be available for your claim.

Yes, but only if you can prove the government had actual or constructive notice of the hazard. Drivers often ask what happens when a pothole damages my vehicle in Georgia, and the answer depends on notice, deadlines, and comparative fault rules.

It’s the required written notice of your claim. For most city/county claims you generally must send it within 180 days; state-maintained roads (GDOT) have different timing and delivery rules. Send it to the right office and keep proof of delivery.

Clear photos/video of the pothole and damage, exact location and date/time, repair estimates/invoices, 311 report numbers or prior complaints (showing notice), and witness statements.

Use comprehensive coverage to get repairs moving. If the city is later found liable, your insurer can pursue reimbursement (subrogation). This avoids long delays.

If you’re found 50% or more at fault (e.g., speeding, distraction, unsafe tires), you can’t recover. If you’re under 50% at fault, your recovery may be reduced by your percentage of fault.

Vehicle repair or total loss value, towing and rental costs, and other proven out-of-pocket expenses. Government damage caps may apply under the Georgia Tort Claims Act.

Claims involving state-maintained roads follow GDOT/State rules, including different ante litem timing and delivery requirements. Identify the correct jurisdiction before you send notice.

Immediately document the scene, report the pothole (e.g., 311 or GDOT), notify your insurer, and send your ante litem notice before the deadline. Missing notice or delivery requirements can bar your case—even if you’re right.

Sí. Hablamos español. We provide bilingual support so Spanish-speaking clients have full access to our attorneys.

This information is general and not legal advice. Deadlines and procedures can change by jurisdiction. Consider speaking with a Georgia attorney to evaluate your specific situation.

Contact our Georgia car accident lawyers today for a FREE CONSULTATION!

Thompson Law charges NO FEE unless we obtain a settlement for your case. We’ve put over $1.9 billion in cash settlements in our clients’ pockets. Contact us today for a free, no-obligation consultation to discuss your accident, get your questions answered, and understand your legal options.

State law limits the time you have to file a claim after an injury accident, so call today.