Recognized by Super Lawyers® | Serving Atlanta Clients Statewide

At Thompson Law, our Atlanta wrongful death lawyers fight and win for injured clients across Georgia — we’ve recovered more than

$1.9 billion in verdicts and settlements. Families in Atlanta and surrounding neighborhoods — from Buckhead and Midtown to

Sandy Springs, Decatur, and East Point — trust us to stand up to powerful insurance companies and deliver results.

Whether you were hurt in a car crash on I-285, a truck accident on Peachtree Industrial, a

motorcycle wreck downtown, or suffered the devastating loss of a loved one in a wrongful death claim, our attorneys

know the local courts, laws, and roads that define your case.

Atlanta Office:

1201 Peachtree St NE, Unit 2200, Atlanta, GA 30361

Free Case Review 24/7:

(678) 981-9022

When your future is on the line, you deserve more than promises. You deserve proven results. Contact Thompson Law today — and let

The Lion of Atlanta fight for the justice you deserve.

Losing someone you love because of negligence or wrongdoing is devastating — but the steps you take next can protect your family’s future and strengthen your claim under the Georgia Wrongful Death Act (O.C.G.A. § 51-4-1). Here’s what our attorneys recommend: Tip: If grief is preventing you from calling, ask a trusted family member to reach out on your behalf — every day matters when building a strong case. At Thompson Law, we move fast to protect your family’s rights and start building a winning case. We’re available 24/7 to answer your questions and begin the fight for justice.

Georgia uses a modified comparative fault rule

(O.C.G.A. § 51-12-33).

Your recovery is reduced by the percentage of fault assigned to the decedent — and

barred entirely if they were 50% or more at fault.

Our attorneys use accident reconstruction, expert analysis, and investigative tools to push back against exaggerated fault claims by insurers.

In some cases — such as trucking accidents under Georgia’s motor carrier laws — we may be able to bring a direct claim against the defendant’s insurance carrier.

This strategy helps ensure all available coverage is pursued and keeps the pressure on insurers to pay full value.

— protect your deadline

Understanding the scope of preventable deaths in Georgia highlights why wrongful death claims are so critical. Each year, thousands of families lose loved ones to accidents caused by negligence — from crashes on I-285 to workplace incidents and medical errors. Here’s what the data shows: According to the Georgia Governor’s Office of Highway Safety, there were 1,491 traffic fatalities statewide in 2019, with a fatality rate of Medical errors remain a leading cause of preventable death nationwide, contributing to up to 300,000 deaths per year. In Georgia, these cases often give rise to wrongful death claims against hospitals, doctors, and other healthcare providers. Preventable deaths aren’t limited to traffic. Workplace tragedies also take a heavy toll: These numbers are more than statistics — they represent families whose lives were changed forever. At Thompson Law, we use this data to demonstrate patterns of negligence and strengthen our clients’ cases.Traffic Fatalities in Georgia

1.12 per 100 million vehicle miles traveled. Georgia ranks 4th in the nation for total fatalities, though its rate per miles traveled is closer to the national average.Regional Trends in the Atlanta Metro

Medical Negligence

Workplace & Occupational Fatalities

(BLS data), up from the previous year.

Tragic events leave families overwhelmed with grief. Our attorneys handle the most frequent causes of wrongful death in Georgia and move quickly to preserve evidence, identify every liable party, and pursue full compensation.

Each case demands a tailored strategy — from accident reconstruction and medical experts to corporate document subpoenas and insurance coverage analysis. We move quickly to identify every liable party and pursue the full value of your claim under Georgia law.

Our attorneys fight diligently to secure maximum compensation for your loss. We’ll thoroughly investigate the case, gather critical evidence, and handle all negotiations, allowing you to focus on healing and remembrance.

This difficult time shouldn’t be made more complex by legal challenges. Here’s how our experienced wrongful death attorneys make the process easier for you: Our goal is simple — to support your family, remove the legal burden from your shoulders, and pursue the maximum compensation you deserve.

Georgia law specifies who may bring a wrongful death action for the “full value of the life” and who may bring related estate claims for medical, funeral, and pain-and-suffering damages (O.C.G.A. §§ 51-4-2, 51-4-4, 51-4-5; 19-7-1). Important: Georgia law does not automatically grant standing to domestic partners or siblings. Siblings typically cannot file unless appointed as the estate’s personal representative and there are no spouse, children, or parents. Unsure who should file? Our attorneys can quickly determine eligibility, coordinate with the probate court when needed, and ensure all claims are filed correctly and on time.Priority Order (Most Cases)

Atlanta follows a modified comparative fault rule. This means your family can still recover damages if your loved one was less than 50% at fault for the incident. Wrongful death cases are rarely straightforward. They often involve multiple defendants, complex insurance policies, and disputes over liability percentages. Trying to handle this alone can cost your family significant compensation. Our Atlanta wrongful death attorneys investigate every detail, preserve critical evidence, consult accident reconstruction experts, and negotiate aggressively with insurers to recover every dollar your family is entitled to under Georgia law.How Comparative Fault Affects Your Claim

Wrongful death claims in Georgia typically involve two separate types of damages under state law: These compensate for losses the deceased experienced between the time of injury and death, including: These focus on the losses suffered by surviving family members and aim to reflect the “full value of the life” of the person who passed away: Calculating these damages requires a skilled legal and financial analysis to capture both the economic and non-economic impact on your family. Our attorneys work with economists and experts to ensure no category of recovery is overlooked.

survival damages and wrongful death damages.

Both are critical to ensuring your family receives full and fair compensation.Survival Damages

Wrongful Death Damages

Insurance companies and courts evaluate many factors when determining fair compensation for a wrongful death case. These considerations cover both economic (financial) and non-economic (emotional) losses. Every wrongful death case is unique. Our attorneys collaborate with economists, vocational experts, and investigators to calculate the true impact of your loss and fight for the maximum compensation available.

Choosing the right legal team after a wrongful death is crucial. We combine compassionate support with proven results to help Atlanta families get justice and maximum compensation. At Thompson Law, we handle everything — from investigating the incident and negotiating with insurers to preparing for trial if needed — so you can focus on healing and honoring your loved one.

Trial Attorney • Atlanta, GA Born and raised in Stone Mountain, now in Atlanta. A Georgia Tech Chemistry grad with a J.D. from Washington University School of Law, Phillip brings rare perspective: he

Phillip Hairston

defended corporations and general contractors early in his career—insight he now uses to hold insurers and large companies accountable for Atlanta families.Cases He Handles

Credentials & Memberships

If your family lost a loved one due to negligence in Buckhead, Midtown, Downtown Atlanta, Sandy Springs, Decatur, College Park, or East Point, our Atlanta wrongful death lawyers are here to help. We know the local roads, venues, and courts—from the Downtown Connector and I-285 to Peachtree Street and Ponce de Leon Avenue—and we move quickly to preserve evidence and protect your rights.

Whether the death involved a crash in Midtown, a truck wreck on I-285 near Sandy Springs, a hazardous condition at a Buckhead property, or a pedestrian tragedy in Decatur, we’re prepared to deal with insurers and responsible parties while your family focuses on healing.

Schedule a free consultation with our Atlanta Wrongful Death Attorneys today.

Call Us: (678) 981-9022

Atlanta office: 1201 Peachtree St NE, Unit 2200, Atlanta, GA 30361

Free case review: We’ll listen, answer your questions, and map the next steps—TODAY.

No fee unless we win.* Past results do not guarantee a similar outcome. Each case is different and evaluated on its own facts.

We know that losing a loved one can leave you with more questions than answers. Our goal is to make this process less overwhelming by giving you clear, compassionate guidance on what to expect. Generally, wrongful death settlements are not taxable under federal law. However, every case is unique. We help families understand the financial implications of their settlement and can connect you with trusted tax professionals if needed. Your consultation is completely confidential and designed to relieve some of the burden you’re carrying. We’ll listen to your story, review any available documents, explain your options, and outline what steps to take next. You’ll leave with a clear plan — no pressure, no obligation. Yes. If new evidence, witnesses, or documentation come to light, we will incorporate them into your case. Timely updates help strengthen your claim and ensure the most accurate representation of your family’s losses. Georgia follows a modified comparative fault system. Our legal team carefully investigates every party involved — drivers, employers, property owners, or manufacturers — to make sure all sources of recovery are pursued, even in complex cases. You pay nothing upfront. We work on a contingency fee basis, meaning we only get paid if we recover money for your family. This ensures everyone can access justice, regardless of their financial situation. We consider the deceased’s income, future earning potential, medical and funeral expenses, pain and suffering, loss of companionship, and more. Our attorneys use expert witnesses and proven case results to demand the full value your family is owed. Sí. Nuestro equipo puede ayudarle con reclamos por choques de camiones y consultas gratuitas en español. – FREE Case Review Are wrongful death settlements taxable in Georgia?

What happens during my free consultation?

Can I add new evidence after my case begins?

What if more than one party is at fault?

How do attorney fees work?

How is the value of my case determined?

¿Atienden en español?

Thompson Law charges NO FEE unless we obtain a settlement for your case. We’ve put over $1.9 billion in cash settlements in our clients’ pockets. Contact us today for a free, no-obligation consultation to discuss your accident, get your questions answered, and understand your legal options.

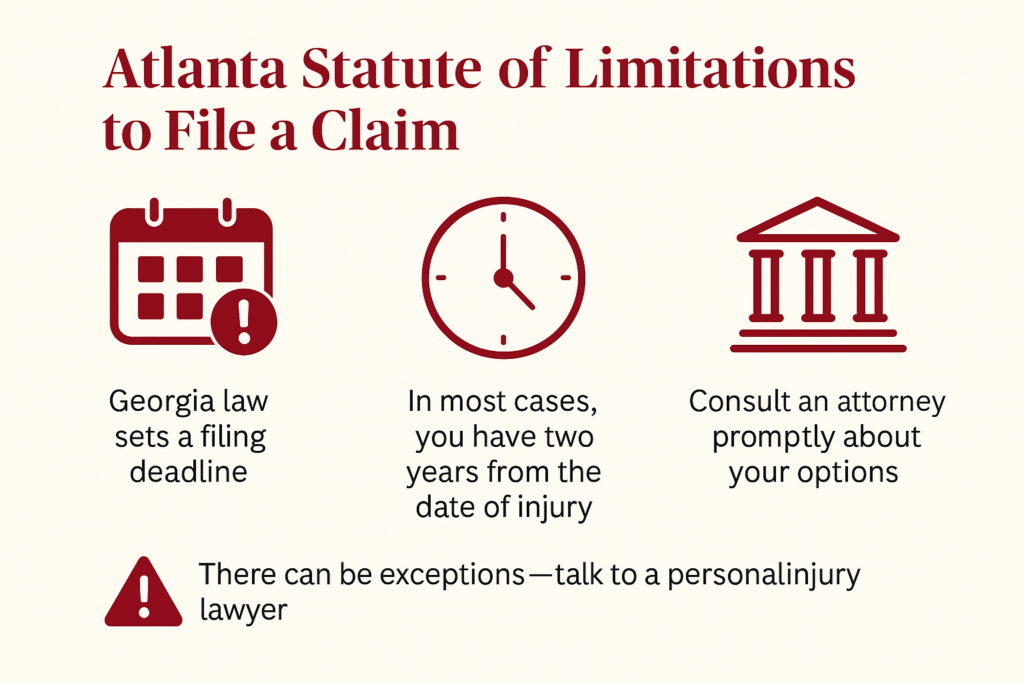

State law limits the time you have to file a claim after an injury accident, so call today.